What does the falling Rupee mean for you?

Sam: I am worried dad.

Dad: What happened son?

Sam: When I had applied for the loan for my course in the US then the dollar was at Rs. 44 and now it has touched Rs. 52.

Dad: Yes son we will have to rework the expenses and think about what to do?

This is the conversation that might be taking place across many households where hopeful students are planning their studies abroad. Often when we read or hear about the falling rupee against the dollar we do not realize that in some way or other it affects us. We feel it is some economic jargon best left to economists and bankers.

What does the falling rupee mean?

The value of a unit of money can be described as the goods and services that unit can buy. Each country has its own currency which is acceptable in the particular country. This means that if you visit Japan and want to buy a juice there you would use Japanese yen and the rupee would not be acceptable.

This means that you will have to buy yen; how do you buy Yen? You pay for it in Indian rupees; so the value of a single rupee is equal to the number of Yen it can buy for you.

This means each currency has an exchange value when compared to another currency which denotes that Unit 1 of A currency is equal to Unit X of B currency. These rates are not fixed and keep fluctuating due to a number of factors like demand and supply of the currency, economic/political condition of the country and more complex factors.

Euro and American Dollar combined amount to 50% of the total foreign transactions in the world which make $ an important currency and the changes in the exchange rate effects the economy most.

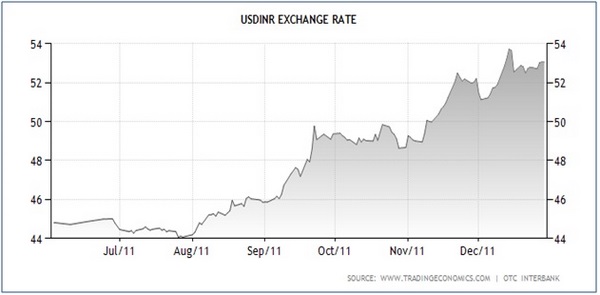

Of late the exchange has been volatile and has not been favorable of the rupee; the chart below gives the trend since the last six months. The value of the rupee has been decreasing in comparison of the dollar sharply over the last few months.

How does a falling rupee impact us?

The rupee dollar exchange rate has a direct impact on people who deal in foreign currency like importers/exporters or those planning their travel; however consumers and the corporate sector are also affected when the rupee dollar or for that matter any other currency equation changes.

Impact of falling rupee on students

As we saw in the above example those planning to study abroad are directly hit by the weakening of the rupee against the dollar. Whether a student has applied for a loan for his course or has arranged for funds on his own his calculation will go haywire with the fall in the rupee value.

July: $1 = Rs.44

December: $1 = Rs.52

Total Estimated Expenses: $ 35,000

Differential: Rs. 210,000 (additional)

This means that Arun might have to cough up an additional two lakhs to pursue his course.

Impact of falling rupee on Consumers

As a consumer we might think that the demon we should be worried about is inflation and not the falling rupee but think again as the falling rupee is going to hit the household budgets and is also likely to fuel inflation. The price of crude oil is going to go up which means that it will set of a chain reaction and hence everything else becomes expensive.

Gourmet cheese, olive oil, fancy sauces and chocolates from international chains, imported furniture and garments, computers and mobile phones are all likely to get expensive. Apart from this the cost of regular FMCG products like shampoos, soaps and detergents is likely to rise as they use chemicals which are a byproduct of crude oil.

Car prices also are heading north; whereas Toyota and Hyundai have already increased their car prices General Motors plans to increase it by January 2012.

Those wanting to travel abroad may have to alter their plans by either postponing it or switching to non dollar destinations; in case you have already made a commitment to the destination then you can only prepare by arranging more funds for your visit.

Impact of falling rupee on corporate sector

For the corporate sector the expensive dollar means a dent in their profits and it also spells that their external borrowings become more expensive. However for the IT sector and as well as for exporters it is good news.

A) Margins:

The most obviously and severely hit are the oil companies as though the price per barrel has fallen in the international markets, the falling rupee means that they continue to pay more for it. In April 2011 the price/barrel was $118 and the dollar was Rs.44 which meant that per barrel cost was Rs.5192 and in November the barrel cost dropped to $109 and the value of dollar was Rs. 52 which means the per barrel cost is Rs. 5668.

The oil companies are not able to pass on this increase in cost immediately to consumers which puts pressure on their margins; however ultimately the consumer will be affected by increased prices of oil. Most multinational restaurant chains have also not passed on the effect of expensive ingredients to the customer and similarly some car manufacturers have deferred the inevitable of increasing the prices. This all means that their profits are strained.

B) Cost of Borrowing:

The largest chunk of the external borrowings (almost 54%) is in US Dollars and for the corporates a weak rupee means costlier loans. If a company borrows $100,000 in April then their total debt is Rs. 4,400,000 but the same loan equals Rs. 5,200,000 in November.

C) Exporters and IT Sector:

The exporters can benefit two fold by this firstly it makes exports from India more competitive particularly as compared to China especially in sectors like garments and leather. Secondly if they have already made a transaction and are yet to receive the payment it means that they get more in terms of rupee. For the IT sector most of the billing is done in dollars which means better revenues for them.

Illustration: Mr Hashim had secured an order for carpets in September 2011 when the dollar was at 46 rupees. He is to receive his payment after delivery in January 2012 by; the dollar is at Rs. 54 means that he makes an additional profit of 17%.

Impact of falling rupee on Investors

For an investor generally a weak rupee spells bad news as it (weak rupee) affects the market sentiment and it also has a negative effect on company profits (as discussed earlier) further dampening the markets. However for an investor who was wise enough to invest in an international mutual fund it is good news.

With the rupee plunging as compared to the dollar, the Foreign Institutional Investors are wary of Indian markets; this means that they may shy from making future investments and what they have they will exit from it and buy it at lower prices. This leads to a vicious circle of further rupee devaluation and the markets getting affected in turn. Less FII investment in the markets also pulls the markets down.

The falling rupee is not all bad news it has some upsides also. Tourism industry can expect to benefit by it and so will the IT sector which is a major job creator for the Indian economy. As for the rest of us it makes more sense to be prepared as being forewarned is being forearmed.

This trend is likely to continue for some time so students and travelers going abroad should keep this is mind while planning their ventures. Similarly those looking at investing in the markets should also do so after careful analysis.

Leave a Reply