Laddering strategy for Fixed Deposits

What is this laddering strategy? Fixed deposits are a good option for people who are risk averse and are happy with limited returns and higher level of safety. For retirees who have a lump sum retirement corpus a fixed deposit can provide a steady return on a monthly, quarterly or yearly basis.

A typical investor

Mr.Chandrasekar, a pensioner from government service decided to invest in a fixed deposit of a public sector bank. The bank quotes an attractive rate of 9% for a 3 year deposit.

Assume that he has a corpus of Rs.20 lakhs and wants to invest in this deposit, he would be earning 9% or Rs.1,80,000 per annum. If the interest is paid at quarterly or monthly intervals the interest payments would be proportionately Rs.45,000 per quarter or Rs.15,000 per month, respectively. Although I’m taking the example of a retiree this applies to anyone who invests a lump sum in fixed deposits.

In the above case Mr. Chandrasekar enjoys 9% returns for 3 years which is not bad at all. There is no guarantee that the rate after a few years will be the same as today.

Case 1

After investing in the deposit, say after 1 year interest rates for fixed deposits in the bank have gone up to 10%. His existing investment is earning less interest than current rates. Now if he tries to break the fixed deposit and reinvest he will lose on the interest and pay a penalty for early withdrawal as well. This is a double whammy.

Case 2

But after 3 yeas if interest rates go down say to around 6%, what happens? He will now be forced to invest at lower rate and lose some interest income. Here again Case 1 can resurface if interest rates go up.

What if I invest at higher rates for long term?

Whichever way you look at it all of us are keen on getting better rates on fixed deposits. For getting better rates one needs to stay invested for longer periods. However, long term investment compromises on liquidity for cash needs and you lose the opportunity to re-invest at higher rates.

The biggest issue here is after the tenure of the deposit (say after 5 years or so), the interest rates can come to rock bottom levels and put you in a big dilemma again.

The Laddering Strategy

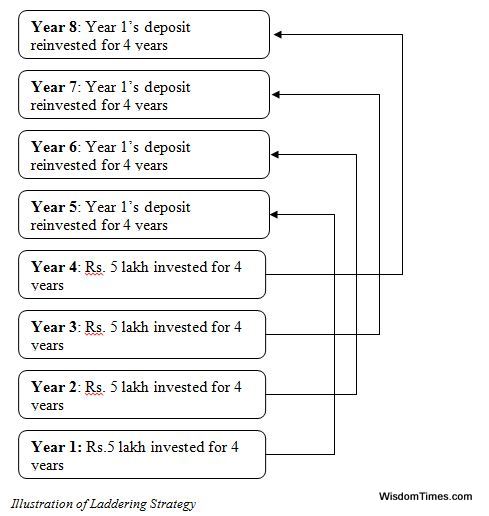

The solution or rather a simple way to balance the above situation is to use a strategy called Laddering. This involves creating an investment ladder one step at a time (like each rung of a ladder). This makes sure that your investment is spread across various period or maturities at regular intervals. A simple example will help us understand the beauty of Laddering.

Taking forward the above example where Rs.20 lakhs is available for investment, Mr.Chandrasekar is advised to break these deposits in to 4 equal parts of Rs.5 lakh each. In the first year he will invest Rs.5 lakh for 4 years followed by another Rs.5 lakhs for 4 years, and so on, till he reaches the 4th year.

In the beginning of the fifth year the 1 year deposit would have matured and can be reinvested. This is where the matured deposits are reinvested gradually as and when they mature after every year.

This can be visually understood from the illustration below:-

How does this work?

You first need to construct a set of deposits (rung of a ladder) every year in such a way that they mature at regular intervals (in this case after every year).

The amount received on maturity of every year can be reinvested for a further term of x years to lengthen the ladder further. This helps you to keep part of your funds liquid for your cash needs or for re-investment at a later stage.

Advantages of Laddering

1. Reduce loss from premature redemptions

Given that term deposits impose penalty on early withdrawal, when rates go up laddering helps you to use your periodic maturity proceeds to reinvest at least part of your funds at higher rate. For example in the above case assume that Rs.5 lakhs was invested in year 1 @ 9% and a similar amount in year 2, 3 & 4 at 8.5%, 8% and 9%, respectively.

In year 5 lets say the interest rate offered is 10%. In this case the year 1 deposit which matures in year 5 can be invested at 10% p.a., while other deposits earn interest at previously booked rates. In year 5 part of the deposits are invested at higher rates, therefore the investor does not need to do premature withdrawals and lose money.

2. Liquidity

Any investment needs to have a window of liquidity allowing investor to access funds without penalties.

If Mr.Chandrasekar invests a lump sum in a 3 year deposit and withdraws funds before maturity, then he will have to lose interest and pay penalties as well.

To avoid this if he has deposits maturing at various intervals, he can access funds at different points of maturity without breaking or closing his deposits.

For instance if Year 1 deposit (of Rs.5 lakh) matures in Year 5 when Chandrasekar needs Rs.2 lakh for a personal emergency, he can withdraw 2 lakhs on maturity and invest the remaining Rs.3 lakhs as per the ladder strategy.

3. Steady Returns

In the case of a rising interest rate scenario laddering may not give you a return comparable to a lump-sum investment at higher rate. But one never knows if interest rates are at a peak. There were periods in the last year when interest rates went up every couple of months.

Lets hypothetically assume interest rates were 6%, 6.5%, 7% and 8% in June, August, October and December in a certain year. If someone is investing Rs.1 lakh every 2 months, he would be investing equivalent amounts in each of these months at respective rates. This provides a portfolio approach where money is spread across different rates.

Remember that Laddering does not maximize the returns but rather makes it more consistent. Laddering is also important for regular income needs after retirements or for those dependent on this income.

Deciding the ladder tenure

You can create a ladder of 5 year deposits or 3 year deposits or even for short tenures of just 3 months. One has to decide on the length of the term based on one’s liquidity needs and considering post tax returns. A short term such as 3 months may be high on liquidity but post tax returns can be low.

One has to strike a balance between factors such as liquidity, returns and quantum of investment. If you can afford to lock in your money for 3-years initially you can start with a 3-year deposit ladder for the next 3 years after which each of the deposits rollover in a cyclical fashion.

Improving your interest inflows

Assume you have set up a ladder with deposits maturing at regular intervals (say every 6 months). Lets say you have additional savings to invest further. In this case you can invest more in the following ways:-

- When a deposit matures add more savings to it to increase the investments

- Try to create new deposit rungs between 2 deposits (If there is one is Jan and June, have one deposit starting in March so you have one between the 1st and 6th month)

These are ways in which you can improve the frequency of maturities and increase your quantum of investment and interest income as well.

Tax Saving Ladder

The strategies adopted above are suitable for tax saving instruments such as 5-year bank deposits, NSC, etc. NSC has 6-year lock in period so a 6-year deposit needs to be constructed every year to make the ladder work. The tax saving ladder can help you save taxed consistently every year instead of investing a huge sum in one year.

Conclusion – Laddering strategy

This is going to be a boring conclusion but the fact is that fixed income instruments are low on returns and are highly tax inefficient. The post tax returns on fixed deposits can be lower than your rate of inflation, so this makes it unattractive.

However, where the quantum of investment is higher the interest income could be still worthwhile although lower than inflation. Although fixed deposits are though of as risk free, they carry interest rate risk. In terms of safety the maximum amount of deposits that is insured is limited to Rs.1 lakh for a single bank. So spreading deposits across banks beyond this limit makes sense too.

The lesson is the fact that there is no return that comes literally risk free, except for government bonds which pay a very low interest with negative yields when adjusted for inflation.

When you invest in fixed investment instruments you should understand that your returns are minimal while capital safety is high ensuring a better peace of mind.

Leave a Reply