Systematic Transfer Plan in Mutual Funds

Systematic Transfer Plan? Oh yes, my financial planner did make a mention about it to me but I found it too complicated, so didn’t get to know more about it. Said my friend Palla, as I happened to discuss Systematic Transfer Plan (STP) with her. “Don’t worry Palla. What I am about to tell you will make you, understand it better”. And for all you readers, should I say Dimple makes STPs simple. Read on to understand how this can work for us.

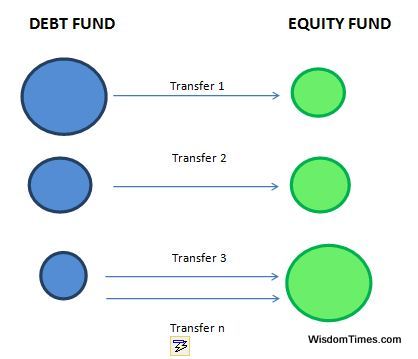

Systematic Transfer Plan or STP refers to an investment plan wherein fixed amount of money can be transferred from one mutual fund to another on a specified date.

This transfer can be made on a weekly, monthly or quarterly basis. Systematic Transfer Plan is generally used to reduce exposure to equities or increase exposure to equities depending on the market conditions; but over a period of time.

This works just like the (Systematic Investment Plan) SIP except that; here money is being transferred from one mutual fund to another, rather than from a bank account. The mutual fund will reduce the number of units equal to the amount you have specified for transfer.

For e.g. If `1000 needs to be transferred from fund A to B, then units of fund A worth `1000 will be sold and transferred to fund B.

Benefits of Systematic Transfer Plan

Let’s look at the benefits of Systematic Transfer Plan –

1) Like a SIP

You can invest a lump sum amount in one mutual fund and have a fixed amount of money transferred to another mutual fund on a periodic basis, just like an SIP would.

2) Like Systematic Withdrawal Plan

When you feel that markets are risky and might go down, you can have money transferred from an Equity fund to a Debt Fund. This will help reduce your exposure on equities.

3) Provides Good liquidity

This is the benefit you get by investing in any mutual fund. Since your money is invested in a debt fund, you can sell the units anytime in case of an emergency or otherwise, and you can have liquid cash in your account in no time.

4) Capital Appreciation

You will benefit from the rise in NAV of the Debt fund or Equity fund that you are invested in.

5) Flexibility

In most funds, fund units are sold so that specified amount can be transferred to another fund. Some STPs provide options wherein only the capital appreciation can be transferred.

So, does Systematic Transfer Plan sound like a new generation financial instrument? Well, here’s how you can make most of it. Let’s look at some scenarios below to see how Systematic Transfer Plan can be beneficial for us.

Scenarios

Scenario 1- Debt to Equity

Now what do I mean by saying Debt to Equity. Money is invested in a debt fund and then transferred to an equity mutual fund on a periodic basis. This is useful when a large sum of money needs to invested in stock markets and timing the market might not be a good option due to volatility in the market.

Let’s take a look at the following example. Nisha has recently inherited `10 lakhs from her father. She has a keen interest in putting this money in stock markets but is apprehensive that she might lose all of it, as the market has been very volatile. Here’s how Systematic Transfer Plan helps her-

1) She invests `10 lakhs in XYZ Debt fund.

2) She can invest the entire amount in a liquid fund or a short term bond fund as this will give her stable returns. Also, the NAV of Debt funds or Liquid fund do not fluctuate much, assuring that the value of her investment will not drastically decrease in response to market movement.

3) She then opts for the STP wherein, every month or whatever interval she prefers, a pre-determined amount of money can be transferred to an Equity Diversified fund.

4) In volatile Stock markets, this helps reduce her risk of timing the markets to ensure that she gets a good purchase price.

Scenario 2- Equity to Debt

This strategy is useful when you want to cash out when you retire.

Look at Shirish’s example, who is now retired and wants to cash out the money he has invested in an Equity fund and reduce his risk. He has accumulated `15 lakhs in an Equity fund but does not want to pull out all the money at once. Here is what he can do-

1) He starts an STP to transfer money from the Equity fund to Debt fund or Liquid fund. This will help him reduce his exposure to equity.

2) He can sell the units of the Debt fund whenever he needs this money.

3) He can also start a Systematic Withdrawal Plan so that money can be transferred to his account on a periodic basis.

Scenario 3- Equity Fund to ELSS

Money can be transferred from Diversified Equity fund to an ELSS scheme of the same fund house.

Take example of Niraj who has accumulated 5 lakh in Equity diversified fund. He does not want to sell it and then invest the money in a fund to avoid transactions costs. This is how he can save his tax-

1) He makes a STP from Equity fund to ELSS fund of the same fund house.

2) Periodic transfers of the money are effected as per instructions.

3) ELSS will provide tax benefits as well.

Thus, in the wake of volatile markets, rising transaction costs and taxes, Systematic Transfer Plan can prove to be useful in many ways. So, when are you becoming ‘STP Friendly’!!!

Leave a Reply