Home Loan Repayment Schedule

Home loan repayment – this is something all of us dread due the constantly changing dynamics. Let’s take a simple example to understand how a home loan repayment works. Most of us have home loans and pay EMIs regularly. Do you know how the home loan repayment schedule works? Do the interest payments increase or reduce over time? We will try answer some of these common queries people have about their home loan repayment schedule.

Home Loan Repayment schedule is intended to simplify your home loan decisions by providing you with an estimate of your mortgage repayments. These calculations are based on the financed amount requested, the length of the loan term, and the interest rate.

Mr. Fernandez, a Manager of a large BPO in Gurgaon was looking to book a property in the satellite city. However he was not sure how home loan repayment works. He consults with his colleague Sriram a Financial Analyst in his company to get his views. Sriram explains to him how a home loan repayment schedule works.

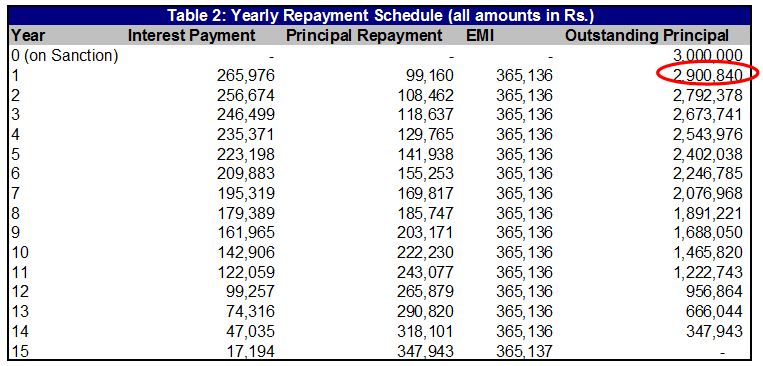

Let us decipher some of the key points out of the home loan repayment schedule and understand how it works. It appears complex initially, but as we start looking at it step by step like peeling an onion the process becomes relatively easier.

Assumptions: Before we proceed further lets understand certain assumptions and limitations of this article.

- The repayment schedule assumed here is for a property which is ready to occupy. In case of a property under construction the loan is sanction in parts and is not covered here for our discussion.

- The repayment pattern and methodology can vary from bank to bank. Some banks follow a monthly reducing balance where principal payment is reduce after each monthly payment, while some follow an annual reducing method.

- We are assuming a constant EMI for the loan tenure as on date. Changes in EMI due to increase or decrease in rates is not shown in the tables.

- In addition to these there can be differences in interest calculation methodology.

- In some cases banks also offer special schemes where EMIs can vary over the loan tenure.

Loan Assumptions

Let us assume that Fernandez have been sanctioned a loan of Rs.30 lakhs for a tenure of 15 years @ 9% interest p.a. The assumptions and EMI are shown below.

Assumptions

Loan Amount Rs.30,00000

Tenure (in years) 15

Rate of Interest (per annum) 9%

EMI 30,428

The monthly home loan payment works out to Rs.30,428. This payment consists of both interest as well as principal component of the loan. This payment will last till the end of the tenure, which is till the last month of the 15th year as per current schedule.

Interest & Principal Payment Calculations

When the loan is sanctioned the loan amount is Rs.30 lakhs. On the first month the interest payment would be equal to Rs.30 lakhs X 9% divided by 12 to arrive at the monthly interest rate. The interest on the first month works out to Rs.22,500.

We know the EMI is Rs.30,428, so the principal should be Rs.7,928 (i.e. 30,428 – 22,500).

Note that the EMI of Rs.30,428 is fixed as of now based on current interest. Please see the Table 1 where monthly payments are illustrated in detail.

Second Month & Subsequent Interest and Principal Repayments.

Interest = Rs.2,992,072 X 9% divided by 12 = Rs.22,441, which means

Principal = Rs.30,248 – Rs.22,441 = Rs.7,987.

The procedure for calculating interest and principal for 2nd and subsequent months is as below:-

Interest Payment = Outstanding Principal (of previous month) X 9% X (1/12)

Principal Repayment = 30,428 (EMI) – Interest payment

Observations from Home Loan Repayment Schedule

If you look closely at the repayment pattern the following observations are clearly evident over a period of time.

- EMI remains constant

- Interest reduces over time as you make monthly payments

- Principal increases as interest reduces

The key point is that as time progresses your EMI’s principal component will gradually start increasing.

This means during initial years you are paying more toward interest and less towards principal.

The real benefits or fruits of a home loan will become visible over the years, when your loan payments go towards principal, thereby reducing your outstanding principal. (This is seen in Table 1 and more significant in Table 2)

This table will last for 180 months until the outstanding principal becomes zero. For the sake of brevity we are restricting the table to 12 months. However, we can see the annual repayment schedule, where the consolidated numbers of 12 months is shown. Note that the principal outstanding after 12 months (in Table 1) is the same as principal outstanding after year 1 (in Table 2).

Takeaways from the Home Loan Repayment Schedule?

We have seen how the repayment schedule works and the basic math behind it. Now I am not going to get in to the quant and science behind. We know interest declines, while principal goes up over the years. This can affect the borrower’s finances (positively or negatively) in the following ways:-

Tax Deduction on Interest

There is a tax deduction on interest payment up to Rs.1.5 lakhs. Assuming a borrower is in the highest tax bracket (30%) this can save him Rs.45,000 in tax out flows. (Tax laws change from time to time so please don’t use this information as a sole factor in your decision making. Consult a tax professional)

The tax benefit to the maximum level (Rs.1.5 lakh) is available till the end of Year 9

Principal Declines vs. Property Value

Principal payment declines by around Rs.1 lakh in the initial year but declines by Rs.2 lakh or more during year 9 on wards. However, this may not be so drastic because future interest can rise making this less significant.

Lets conservatively assume that principal declines by 3% p.a. initially, but property values may move up by 7-8% p.a. Note that banks give a loan of up to 80% of the property value. So in the above case the property value initially would be close to Rs.37.5 lakhs.

Overtime the property value will increase gradually, while principal outstanding will increase. This gap will be the asset value or capital appreciation on your investment. If you remember the concept of ‘lever and fulcrum’ in high school physics, you will understand that as property value goes and principal declines your Net Worth is getting boosted by a few lakhs every year.

Rental Income vs. EMI

Assuming the property is rented out, the initial rents would be lesser, but increase in rentals in future will cover your EMIs significantly or even fully. For instance if Fernandez rents out the property at Rs.12,000 initially he needs to shell out Rs.18,428 in order to pay an EMI of Rs.30,428.

However, assume that over the next 5 years rents move up to Rs.20,000, then he just needs to shell out Rs.10,428 from his pocket in future. Remember, this is the greatest advantage of leverage because after 5 years his income would also have doubled.

Conclusion

Home loan repayment is a very important aspect that one has to be aware before taking the plunge in property investments. Property investments are suited for long term investors who have the patience and holding power. The true power of leverage can be harnessed if one waits for a longer term and pays their EMIs consistently without fail.

This is not very different from equity and other investments where financial gurus recommend SIPs (Systematic Investment Plans).

A home loan is conceptually similar to an SIP with a Leverage Multiplier which can magnify your Capital Appreciation because you are able to get a low cost funding for a long term and manage to build an asset that delivers capital appreciation as well as rental savings/inflows. To sum up I would conclude that investment in one property is a must for every individual because it can provide multiple benefits over a medium to long term.

Leave a Reply