Financial Planning for Retirement

Financial planning for retirement is important to lead a stress-free life in the twilight years. The first question you need to know while planning your retirement is “How much money you will require for retirement?” For this you need to know when you will retire and how much of expenses (monthly and annually) you need post retirement.

Once you have answers to these questions you know your assumptions and future plans. This will help you to keep track of whether your actual financial situation is in tune with your expectations. If not you will be able to take corrective steps before you decide to hang your boots.

Financial Planning for Retirement

Financial planning for retirement is too pressing to be taken up when you are just a few years away from retirement. Those planning for a smooth retirement need to look at two broad areas:

- Know your rough retirement kitty (or requirement)

- Challenges you might face. How to deal with it?

The first step is critical because it will give you a sense of challenges that can significantly impact your future life goals and plans in addition to your financial situation.

How Much is your Ballpark Retirement Kitty? (Planned Retirement Corpus)

It is very difficult to calculate this because you need to take several variables such as current income, expenses, future increase in income, inflation, lifestyle changes, etc. However, one can make a simple ball-park estimate by tweaking some assumptions.

Let me give you one scenario (you make adjustments as per your situation).

Let me give you one scenario (you make adjustments as per your situation).

Name: Mr.Suresh

Age: 55

Monthly Personal Expenses: Rs.30000 (required to maintain normal lifestyle and daily needs)

Dependents: None (since his children are earning already)

Assuming he plans to retire in 15 years at the age of 70, and given that inflation (price rise) is 10% every year, then his post retirement expenses would be Rs. 125,317. Over Rs.1.2 lakhs per month? Does it sound alarming? Yes. That’s the reality you will face during old age.

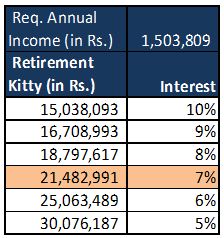

This works out to an annual requirement of Rs. 1,503,809 (i.e. 125,317 X 12).

How Much would the Retirement Corpus (lump sum) be, to Generate Such Income?

Assuming Suresh invests such sum in a regular fixed deposit earning 7% interest p.a. he must invest Rs. 21,482,991 or Rs.2.15 crores to generate Rs. 1,503,809 every year.

So Suresh’s rough retirement kitty works out to Rs.2.15 crore. I’m assuming that the rise in future expenses will get offset by the interest or income from this kitty. This lump sum of Rs.2.15 crore will last for 14 years if post retirement spending is Rs. 1,503,809 per year. However, the inflation rate post retirement may reduce this to 10 years or less.

The kitty can be different if interest earning scenarios differ as shown in the table alongside. The enormous figures shown definitely seem too ambitious but these can be achieved if one breaks these in to smaller milestones and achieves them systematically.

For more on this you can check out this article – Why Retirement Planning is Important

Financial Planning for Retirement – How to Deal with the Challenges?

We will discuss a few challenges or surprises faced by people who are about to retire or those in the middle-age bracket (late 40’s or early 50’s). What you plan and what actually happens in future can be different?

Challenge #1 – Inflation & Savings

This is one challenge because your future expenses would be much higher compared to what you spend today.

A 100 gm pack of cashew biscuits which cost Rs.5 a decade back now costs Rs.10 (prices have doubled over a decade). Cost of education according to rough market estimates is doubling every 5 years. More inflation leads to more expenses, less savings and compromise on Future Financial Goals.

For example you will be spending more on present requirements like food, entertainment, decoration, gadgets, etc, which leaves you with smaller savings.

For example Mr. Srikanth, who works as a Software Engineer with a leading IT company earns Rs.50,000 a month, which is pretty good. He has a wife and a 2-year old son. His household expenses amount to Rs.30,000 a month and since he also pays an EMI of Rs.9,000 for his car, he is only left with Rs.11,000 to save. He also admits sadly that on most occasions he lives from pay cheque to pay cheque to make both ends meet, with no room for savings or investments or future planning.

Solution: Draw up a rough budget and see where most of your spending is headed towards. Try to realign your expenses, boost your savings, which will provide room for future investment and planning.

Challenge #2 – When to retire? What if I’m forced to work longer than I expected? How can I be active?

Although you can have a target age or time to retire, any change in your personal or financial circumstances, will require you to change your targets to suit the new realities

For example, Mr.Purushottam (aged 52), a Senior Bank Executive in Chennai wanted to retire at the age of 60 and settle down in his hometown.

However, he soon realized that in order to meet his rising expenses he should continue working or have to be dependent on his son and daughter in law who are settled in Bangalore. After consulting with his friends and colleagues he decided to opt for a consulting role with his organization where he would act as an Advisor/Consultant and work part-time. This arrangement meant that he could have more time for himself but also have some steady income (even though not as good as fulltime salary).

Solution: One way is to increase your income by moving to better opportunities or boosting savings/investments, but these are easier said than done for people who are about to retire in the next 5 years or less. The alternate is to work for a few more years, and find alternate work options (part time, freelancing, consulting), which you can take up after retirement.

Phased Retirement vs. Sudden Retirement

The case of Mr.Purushottam and many other retirees who worked in good positions show a new trend where people are not opting for a permanent retirement in its truest sense. From a full time position they move on to something part-time or more flexible in nature. Some of the options people take to gradually retire include:-

- Working part-time as an independent professional

- Making an arrangement with current employer or future employer for flexible work schedules/timings

- Become a Consultant/Adviser where you are hired for specific projects only

- Work from home or freelancing options – like writing, blogging, graphics, editing, etc.

- Business Ventures

Challenge #3 – Healthcare and Expenses

The healthcare expenses also go up consistently every year, and given the longer lifespan this can inflate your post retirement expenses. Maintaining a healthy and active lifestyle is the best way to ensure that you minimize on the costs as well as the efforts involved in medical treatments, hospitalization, surgery, etc.

However, despite all this you need to take adequate precautions by consulting doctors when you have medical issues. Money is only one part of the story, you also need to make sure you have a healthy environment and comfortable setting at home during your last days. Make suitable arrangements for this gradually when you are contemplating retirement.

Recommendations: Healthy and active lifestyle, regular health checkups & good environment at home. Since I’m not an expert in this I suggest that you consult professionals in medicine, nutrition and fitness.

Challenge #4 – Earning out of Investments

Most people don’t invest enough and plan for the future. They either spend it on things like entertainment, gadgets, cars, expensive trips, parties, etc. which leave them little room for creating assets. One should plan and invest for retirement (atleast 10% of your income) right from your first job. Otherwise you will have to face retirement blues because your investments will not even be enough to last a year or two.

Mr. Chintamani, a Chief Engineer with a public sector company and retired with a pension (Rs.12,000) which is just barely enough to survive.

During his working years he hardly planned his investments, so today he only has a total saving corpus of Rs.1 lakh, which he says may not be enough to last for 6 months. But 20 years ago Rs.1 lakh was good enough to last for 2.5- 3 years.

Lesson: Try to save and invest in income generating/appreciating assets including gold, real estate, stocks, etc. Just reiterating Robert Koyosaki’s words – ‘An asset is something that puts money in your pocket’. Try to invest in assets which will generate income or appreciate in value terms.

Challenge #5 – Personal Responsibilities and Issues

Most middle aged people have multiple responsibilities such as son/daughter’s wedding, education, etc. Or there could be personal issues such as disability, poor health, family disputes, etc.

Solution: In case of disputes have a neutral person or a Moderator to come up with a reasonable solution or remedy to settle pending issues. In case of responsibilities you may have to make sure that your kids are settled atleast financially before you hang your boots. For properties and assets you need to have a succession plan or a will in place to ensure that these pass on to the right people without legal hassles.

Challenge #6 -Elderly Care & Old age living

Most people think that their son or daughter will take good care of them and don’t think this is a serious issue. However, changing lifestyles and trends can give you serious shocks. What if your son/daughter decides to settle abroad? Who will take care of you? This is critical. In today’s time when nuclear families are becoming common some elders are adapting themselves to live independently or live in elderly living centers (old age homes in local terms) or assisted living centers (for those who require medical or personal support).

I’m not saying that elders should live alone, but circumstances can lead to this situation and one needs to be prepared. However, if you are planning to retire its quite important to have an open discussion with your children including their spouses about this. Are they willing to support you or have you in their household? Having good relations with them as well as being mutually supportive can actually be a much better option than living alone.

For elders who want to keep engaged and earn something there are several options to work from home like writing, consulting, freelance projects, advice/consultations, etc. In case you have special skills like astrology, music, painting, tailoring, tutoring, etc these can be put to use as well.

Conclusion – Financial Planning for Retirement

Although I’m trying to give importance to retirement, it does not mean that you start living frugally to save for retirement. If you are starting your career probably you can save 10% of income for retirement. Some of your long term savings and investments should also be reserved for retirement. If you start early you have more time on your side to plan and make course corrections.

I’ve got a sizeable retirement nest egg. It’s an ostrich egg, and it’s going to make an omelet so big that it’ll produce enough leftovers for decades. ~ Jarod Kintz (Tweet this)

Start your financial planning for retirement as early as possible so that you have a sizable safety net for your twilight years and a peaceful walk into the horizon!!!

Leave a Reply