Understanding Asset Classes – Must Read for Stock Investors

We often hear financial experts talking about being conservative, aggressive, etc. How does a person know if he or she is aggressive or conservative investor? To understand this you need to gauge your own investment risk appetite and understand what asset classes are.

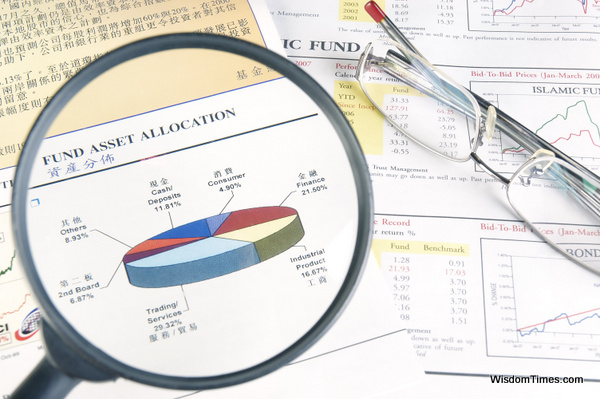

Understand Asset Classes

Asset classes simply refer to various assets available for investment. For this article I’ve identified five broad asset classes.

People investing more in safer avenues avoiding risky assets would generally be considered as “Conservative Investors”. But before coming to conclusions, you need to see how much you invest in each of these categories or asset classes.

Long Term Debt

This includes fixed deposits, bonds, debt mutual funds, etc with a tenure greater than 1 year. Fixed deposits offered by banks are more safe compared to corporate fixed deposits. Within corporate fixed deposits the ones offered by large companies with good credit rating (rated by CRISIL, ICRA) are safe.

Short Term Debt/Liquid Funds/Cash

This includes short term debt securities or debt mutual funds or liquid funds with a tenure less than one year. Liquid funds can be called ‘very short term’ debt because they invest in securities maturing in less than 90 days. Liquid funds are meant as short term parking place for you savings when you are not sure where to invest. Cash held in bank as savings is also considered as one component although it is not a typical investment.

Equity-Large Cap (Blue Chip)

Stocks of large cap companies such as HDFC Bank, ITC, ONGC, etc. These are companies which have a leadership in their industry as well as high level of reputation, experience, project management capabilities as well as superior brands. Further, qualities like quality of leadership, ethics, governance, etc will also be a plus.

Equity-Small/Mid Cap, Others

Stocks of mid sized or smaller companies which have shown good growth potential and hold promise for bright future ahead. These are like the emerging stars which want to get in to the big league in the coming years.

Gold ETF

This is an exchange traded fund, which represents one gram of gold. These ETF units can be traded in multiples of 1gm.

Read how these asset classes play a role in determining your investment profile in our blog – what kind of investor are you?

Leave a Reply