ELSS- A Good Tax Saving Tool

Come the April month of the year and all that we think is “What can I invest in to save tax”. We have the traditional Public Provident Fund, National Savings Certificate and the pension funds as well. And the tool now catching the fancy of every other investor is ELSS or Equity linked Saving Scheme.

ELSS is basically a diversified equity fund with tax benefits. ELSS basically invests in stocks across various sectors like Infrastructure, Pharma, Natural resources, Banking, etc and provides tax benefits.

ELSS like other mutual funds declares dividends on yearly basis. The dividend received is tax free. ELSS comes with 2 options:

1. Dividend payout- wherein one can opt for the dividend to be withdraw and deposited in the bank account and

2. Dividend Reinvestment- wherein the dividend received in invested back in the fund, by way of purchase of additional units of the fund.

ELSS – What do the Stats say?

ELSS was notified as tax saving instrument in November 2005 under Section 80c of the Taxation Act. Once the maximum investment limit in ELSS was raised from `10,000 to 1 lakh, there was no looking back.

In March 2006, the assets under management were at `5,089 which increased to `8417 in March 2007; a straight increase of 65% in one year. As of Feb 2011, the AUM of ELSS alone is approximately at a whopping `5181 billion!

As of 30th May 2011, following were the top 5 ELSS funds. Please get the latest returns and top performing funds from www.mutualfundsindia.com

ELSS – Why is it attractive to investors?

Well, here are the advantages of ELSS

- Lock in Period- is of 3 years against others like PPF (Public Provident Fund) or NSC (National Savings Certificate) which is 6 years.

- Returns not taxable- Neither the capital gains received at end of maturity nor the dividends are taxable. Sounds unbelievable, but this is true!!

- No entry load- If a person invests `5000 in ELSS, he gets units worth the entire money.

- Option of Availing Dividend- so, one can get some gains during the lock in period as well.

- Higher Returns than other tax saving instruments- As it is equity linked, earning potential is high. NSC and PPF give a return of 8% which is taxable.

Advantages do come with a certain amount of disadvantages such as-

- Like all market related instruments, the risk is higher than NSC and PPF.

- Premature withdrawal is not allowed.

Let the numbers Speak for Themselves!

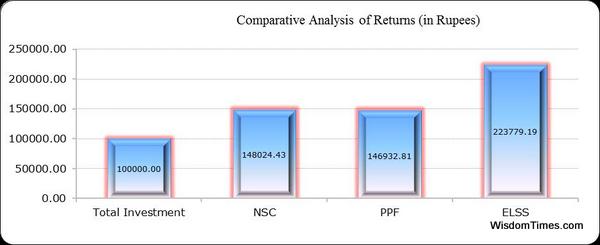

To provide a better perspective of the returns given by ELSS, a comparative analysis is done with PPF and NSC, the more traditional tax saving products. Let’s look at the following case study:

Suppose Rahul invested 1 lakh each in ELSS, NSC and PPF in April 2006 for 5 years. For ELSS, I have assumed that Rahul invests in a fund “Fidelity Tax Advantage Fund- Growth” which has given annualized 5 year return of 17.48 % in May 2011.

Rahul has opted for the growth option, which means that any dividend received would be reinvested in the fund. The rate of return for PPF and NSC is 8%.; however PPF is compounded annually and NSC is compounded semi-annually. Amounts at the end of 5 years would be as follows-

If we see the chart above, we can clearly see that ELSS has given higher returns compared to the other 2 products. The returns we see above for the ELSS fund are annualized. However, if we do some research on other funds and look at the cumulative returns, they show returns of upto 30-40%. In times of rising inflation and taxes, ELSS seems to be our best bet.

Thus, we can understand the reason why ELSS is becoming a preferred tax saving tool.

Leave a Reply