Gold Savings Funds vs Gold Exchange Traded Funds

The yellow metal, Gold has been used for centuries as a currency or as a store of value. In recent times common people are also keen on investing in gold in electronic form in addition to jewelry and other physical forms of gold.

Gold exchange traded funds are open-ended mutual fund schemes that will invest the money collected from investors in standard gold bullion (0.995 purity). The investor’s holding will be denoted in units, which will be listed on a stock exchange.

Gold exchange traded funds have been a success story around the world and Indians are warming up to the idea of investing in it since they were launched in 2007. Gold savings fund is that one can invest in gold funds without a demat account and can set a SIP for the same, which is true.

The concept of investing in Gold through exchanged traded funds existed for more than 5 years, but it has picked up fast in the last 2-3 years due to the global turmoil in late 2008 and volatile markets that prevailed later. Today Gold is seen as an important part of an investor’s asset class.

Emergence of Gold Savings Funds

Gold exchange traded funds are instruments which mirror the price of gold and are easily tradable in the market. One can easily buy/sell through a demat/trading account. Each Gold exchange traded fund unit represents one gram of gold (barring few exceptions) and one can buy one or more units as per one’s budget or need.

What are Gold Savings Funds?

Recently many fund houses have launched a new product called ‘Gold Savings Funds’. These funds are basically feeder funds which pool investments from various investors and invest in Gold exchange traded funds.

For example Reliance Gold Savings Fund invests atleast 95% of its corpus in to Reliance Gold exchange traded funds, while the remaining corpus in short term deposits or money market securities or liquid funds.

Disclaimer: The website and the author are not necessarily recommending a buy/sell/hold on specific funds or schemes. Readers are advised to consult their financial advisor and read the product information documents for complete information about each product/scheme. The examples shown are purely for knowledge and illustration purposes.

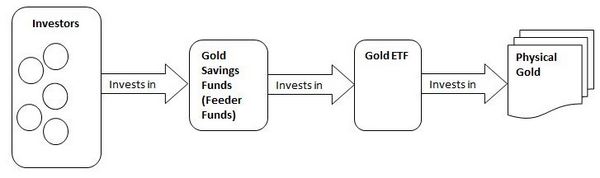

Graphics of How Gold Savings Fund Invests Your Money

As shown in the illustration Gold Savings Funds collect savings and funds from multiple investors. These funds are collectively invested in Gold exchange traded funds predominantly. The Gold exchange traded funds further invests the sum in physical gold which is maintained with the custodian in a warehouse. If you invest in Gold exchange traded funds, the fund directly invests in physical gold, and the process gets shortened.

Let’s examine how Gold Savings Funds are different from Gold Exchange Traded Funds:

| Feature | Gold Savings Fund | Gold ETF |

| Mode of Investment | Through the fund | Buy from stock exchange though demat/trading account |

| Minimum Investment | Rs.5000 (lump sum) initially and addition purchases of Rs.1000 and aboveRs.1000/month for 6 months in case of SIP | Amount equal to 1 gm of Gold(QGold offers the option to invest in 0.5 gm of gold) |

| Systematic Investment Plan | Available | No. But investor can decide to invest systematically as per his or her needs |

| Entry Loads | Nil, however some upfront commission may be payable (to distributor) if you invest through a distributor. | Not Applicable |

| Exit Load | 1%-2% and varies depending on the fund and timing of exitAfter 1 year there is no exit load generally | Not applicable |

| Transaction Costs | The fund incurs brokerage and delivery costs on purchase or sale of ETFs. | Brokerage costs, delivery charges in case of sale. Transaction costs amount to roughly 1% of the transacted value |

| Liquidity (Redemption) | Investor has to bear exit load (as applicable) on redemption | Highly flexible since you can sell any time and withdraw funds net of brokerage/delivery costs |

| Total Transaction Costs(assuming no distributor exists) | Brokerage, delivery cost, exit load | Brokerage and delivery costs only |

| Fund Operating Expenses | Occurs at feeder fund level and at the ETF level | Occurs at ETF level only |

| Strategy | Moderately flexible.When gold prices are at peak your SIP will still be buying.You cannot buy or sell as you wish due to the constraints seen above. | Highly flexible except that you have to purchase min. one unit.You buy/sell as per your investment strategy and asset allocation |

| Tradable in the market | No. | Yes |

Benefits of Gold Savings Fund over Exchange Traded Funds

- You don’t need a demat account and you can invest through fund

- Systematic investment plan enables you to invest regular sums automatically in a disciplined manner, which is not available in case of ETF. However, in ETF investors need to have their own discipline and have to manually invest regularly.

- Market timing is done away with, which is favorable for people who want to invest without worrying about prices.

How Exchange Traded Funds Scores Over Gold Savings Fund

- Minimum investment in case of exchange traded funds would be equivalent to 1gram of gold (roughly around Rs.2600 at current market rates). In case of Gold Savings funds its Rs.5000 (lump sum), while in case of SIPs you can invest a minimum of Rs.1000/month for 6 months.

- Gold exchange traded funds can be sold any time and liquidated at prevailing market prices less brokerage charges.

- The transaction costs are less because you only pay brokerage and delivery charges which will not exceed 1% depending on the frequency of transactions.

- You can time your purchases depending on market trend

- The flexibility to enter or exit also allows you to manage your asset allocation by increasing or decreasing your allocation to Gold compared to overall investments.

Performance: Both gold savings funds and ETFs should exhibit similar performance since both track the physical gold prices. The underlying asset is gold in both cases, and the investment vehicle is also Gold ETF in either case. However, Gold ETF will have a marginal edge over gold savings funds. In case of savings funds, there is an additional layer of expenses incurred in case of savings funds to mobilize funds, manage the portfolio, overheads, etc. The costs are higher in case of savings fund because – you pay for gold ETF as well as for gold savings fund – so make an informed choice.

Note that most funds have launched gold savings funds due to the reasons below:

- Investors can get an option to invest in electronic gold without having a demat account.

- A systematic investment route would help investors who are not comfortable with exchange traded funds where one needs to decide when to buy, how much to buy, etc. For example if you invest Rs.5000 every month if gold price is Rs.2500/gm in month 1 you will get 2 units, and if price drops to Rs.2400 in month 2 you will get 2.0833 units (5000/2400).

- Most funds that have Gold exchange traded funds product also have a gold savings product because they want to attract a larger customer base. Moreover, SIPs will also ensure regular inflows and higher participation in ETFs. I agree with experts who point out that gold savings fund is designed to benefit the fund more than the investor.

What is The Final Verdict?

Obviously most factors are favoring exchange traded funds. My simple advice to people who have a demat/trading account is to ignore gold savings funds altogether. Why? Since you already have a demat account and are paying charges for maintenance and also have equity investments, you can leverage the same to invest in gold as well.

The costs are less too. So why go for another fund investment, when the same account can be used to hold stocks and gold? However, for people who don’t have a demat account (and not planning to have one), the gold savings fund route works well.

Leave a Reply