Buying Gold after Akshaya Tritiya

Gold has always been one of the most popular forms of investment. The obsession with buying gold goes a long way in history. Investors race to the yellow metal in a flight to quality, as a means to protect wealth, a hedge against inflation and as an insurance against extreme movements in other asset classes.

The month of April/May seems to be a good season for the precious metals industry, particularly for jewelers who sell gold. Akshaya Tritiya is known to be an auspicious day that brings good luck and success. According to Hindu mythology, on this day the Treta Yuga began and the river Ganges, the most sacred river of India, descended to the earth from the heaven (Courtesy: Wikipedia.org).

The word “Akshaya” means never diminishing, which means any action you do will result in a positive or constructive outcome. In simple terms any new initiative/venture started on this day will have a good future.

Buying Gold – Tradition Becomes a Trend

This tradition of doing something new – either business, charity, purchase of land, investment, etc. was initiated as a trend. Some jewelers also cashed in on the trend and also used it as one of the reasons for encouraging customers to purchase ornaments or jewellery. This trend is also spreading to other sectors like real estate, cars, computers, etc.

How many of you have heard about Akshaya Tritiya 5 years ago (prior to 2007)? Very few might have even heard of such a term. Its only in the past few years that this trend has caught up.

How many people in India knew about Valentine’s Day about a decade back? Some people might have heard and few would know its significance. Valentine ’s Day is also a trend created to boost the sales of greeting cards, gifts, chocolates, etc. Earlier retailers were dependant on Christmas and New Year and a few other occasions. Now after the Christmas/New Year season, the Feb 14 day provides another season for them to cash in.

The trends discussed above may favor the retailers or sellers rather than end-consumers like you and me. Similarly Akshaya Tritiya was also tried and tested and has now established its importance even in today’s modern tablet PC times.

Should you Invest in Gold on Akshaya Tritiya?

Not necessarily. Now, coming to the main point, I am not trying to debate or question whether buying on Akshaya Tritiya is good or not. However, its not a good idea to buy only during Akshaya Tritiya.

You should have a proper strategy in place and buy when gold prices are attractive – irrespective of whether the day is auspicious or not. However, I am not against the tradition or people who follow it, so for them I have some advice below:

If traditions/rituals are important: For those who still want to follow the tradition or rituals relating to Akshaya Tritiya, I would recommend the following:

- Make a small token purchase/investment on the auspicious day

- The remaining purchases or buying can be done when prices are attractive.

Issues with Auspicious Seasons

Buying gold on the day of Akshaya Tritiya – Few Tips

- Buying at Peak: The prices can zoom to astronomical levels for few days or weeks forcing you to buy at peak levels.

- Opportunity to Buy Low can be lost: You also miss the opportunity to buy gradually/systematically at different time periods when prices are down.

- Liquidity: In case you want to sell immediately after buying you may not be able to do that. Instead you may have to wait for a long time or till next season to sell at a good price

- In times of crisis, buying gold is safest which has the greatest potential to increase your wealth.

- Gold is a portable, private and anonymous investment option.

Relationship between Gold Prices and Occasions

There is no perfect mathematical relationship or proven trend showing that buying Gold on Akshaya Tritiya or Diwali will result in sure-shot gains. However, if you buy at lower prices on normal days, it is most probably likely to appreciate on special occasion such as Diwali.

Based on personal experience I can say that when I buy on a day when Gold price dips, I am reasonably confident that its price will appreciate significantly by Diwali. But if I buy on Diwali day at a high price, I might end up waiting for a few weeks, months or till next season to regain the purchase price.

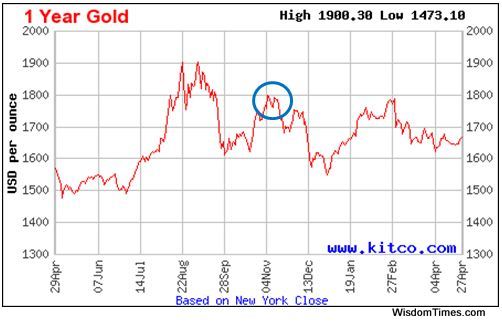

Chart: This is a 1 year gold price chart showing data up to 27 April 2012. These are gold prices represented in US$ per ounce.

What the Trends Show?

For instance if you look at the above chart the peak price highlighted in blue during November is a clear indication of gold prices getting a boost during Diwali season. Since India is one of the major consumers of gold, domestic trends also impact global prices.

What if you bought in Akshaya Tritiya (April or May in 2011)? Incidentally you make an excellent decision because going by the chart above, prices have not fallen since last Akshaya Tritiya. However, if we look at past data for the last 5 years there have been occasions when prices have dropped after Akshaya Tritiya, so its not right to assume that Akshaya Tritiya is the best time to buy.

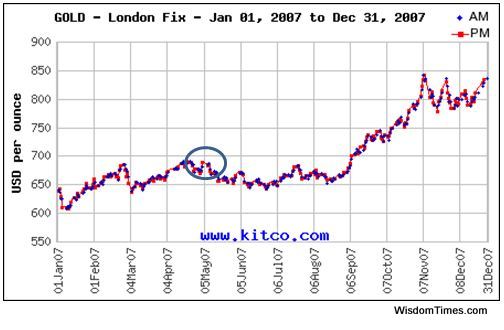

2007 Gold Story: The blue ring shows the prices during Akshaya Tritiya in 2007. Prices have dropped after that season, but later recovered in September, and had a good run up in Diwali and later. But 2007 bull run had to pause and consolidate in 2008.

2008 Gold Story: This was a good year when Gold crossed the landmark $1000 mark for the first time. Even though prices were down before Akshaya Tritiya, the situation worsened by September-November when large financial institutions including Lehman Brothers, AIG and others were facing crisis, which had a global impact.

Timing Gold Purchases Based on Events

Sometimes gold prices can shoot up on normal (non-occasion) days due to international economic developments like Greece debt default, Lehman Brothers crisis, US easing monetary policy, etc.

Remember that gold is a global commodity and can get influenced by external factors beyond India. The best time to invest on gold is when there is no news on gold or when people are not gung-ho about gold.

Sometimes when prices crash and experts talk about gold prices correcting and will fall further, it’s a good time to buy gold gradually (not in one shot).

When media talks about gold prices hitting record highs, just avoid the temptation of buying and don’t act on such news. It is generally better to wait and buy even if prices shoot up in future.

Conclusion – Buying Gold

My humble suggestion to all readers is to follow a systematic process for investments. If you want to go by the traditions restrict it to a few token purchases (few grams). Other than the token purchase, your investment decisions should be based on facts and real data.

The desire for gold is the most universal and deeply rooted commercial instinct of the human race ~ Gerald M. Loeb (Tweet this)

Buying gold is safe in the sense that it never really depreciates in value and provides a safer long-term investment. Though gold yields profit with time but it is considered dead weight as it does not bring in steady flow of cash.

Depending on your asset allocation and style of investing you can allocate up to 25% in gold. To know how much of your portfolio should go in to gold, you can consult a financial advisor and get advice. If you are doing it on your own you can add gold ETFs gradually and fine tune your holdings based on your experience.

Irrespective of the occasion, its always a good idea to add a flavour of gold to your portfolio to get hedged against inflation as well as to diversify from financial assets such as equity and debt.

Leave a Reply