Rajiv Gandhi Equity Savings Scheme (RGESS) – Is it beneficial for you?

There has been a lot of talk on investing in equities, but over last three years, most investors seem to be staying away or going out from equity markets. Moreover, potential investors are also too risk-averse to invest their hard earned money and prefer to take refuge in small savings schemes, fixed deposits or gold.

This resulted in lot of savings lying in banks, gold lockers, which are mostly idle and hardly put to use. On the other hand companies and industries were struggling to raise finance for new projects, in a market where growth and expansion plans require more capital.

Given this context the Government came up with a scheme called Rajiv Gandhi Equity Savings Scheme (RGESS) to encourage more savings to follow in to equity markets by giving appropriate tax benefits. The idea was to streamline savings and capital in to industries to aid economic growth and development.

The Rajiv Gandhi Equity Savings Scheme (RGESS) might appear to be a complex puzzle for beginners. So lets try to understand part by part before we decide on how good or beneficial it is for you.

Who can Invest in Rajiv Gandhi Equity Savings Scheme (RGESS)? – Eligibility

To invest in Rajiv Gandhi Equity Savings Scheme (RGESS) you need to :-

- Be a resident of India.

- Be a new or first-time investor in equities/stocks.

- Have an annual income of less than or equal to Rs.10 lakhs.

- You should not have a demat account, however, if you have one account without any transactions you will still be eligible.

To put it in a nutshell, this is open only for new investors who have not at all invested in stocks or equities. Further, those earning above Rs.10 lakhs are not eligible for this. For more details you can also visit RGESS

Eligible Securities

The Rajiv Gandhi Equity Savings Scheme (RGESS ) is applicable for certain eligible securities as follows:-

- Stocks in BSE 100 or CNX 100

- Shares of Maharatna, Navratna & Miniratna

- Units of mutual funds or exchange traded funds which have underlying securities which are part of the above eligible securities

- Follow-on public offerings

- New Fund Offers of eligible mutual funds and exchange traded funds

- IPO of public sector undertakings subject to certain conditions

For more details visit BSEIndia/RGESS

Since the potential investors are new to stock markets, the Govt. wants to ensure that the investment universe is restricted to the top companies in the index and predominantly blue-chip companies with good reputation and business history. The idea here is to ensure that the investment is safe with some stable returns for first-time investors.

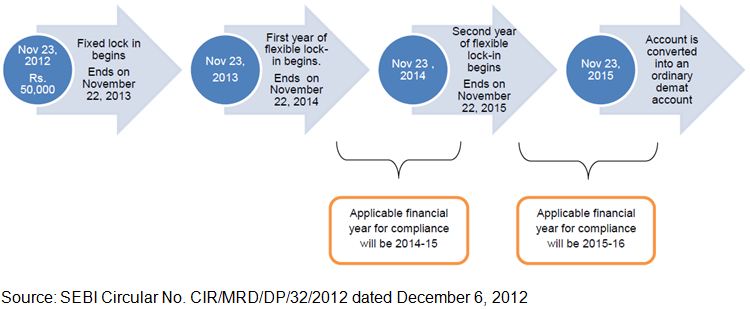

Lock-In Period

Fixed Lock-In: There is a mandatory (automatic) lock-in period for the first one year from the date of investment. This period is called ‘Fixed Lock-in’

Flexible Lock-In: During subsequent two years the investment is subject to ‘Flexible Lock-in’

In the Flexible lock-in period the investor can buy or sell securities but (s)he needs to maintain the value of RGESS investment (Rs.50,000) for the next two years.

Since this is a complex area involving tax treatment, you can also consult a tax advisor or consultant to get second opinion. You can also get some detailed information on BSE website at BSE INDIA/RGESS which should answer most of your questions.

Tax Benefits

The eligible individual can invest up to Rs.50,000 in the first year of investment only. You can get a tax deduction of 50% of the amount invested. Since the maximum investment is Rs.50,000 you can get a maximum deduction of Rs.25,000 (50% of 50,000). If the invested amount is lesser (say Rs.40,000) then you get a deduction of only Rs.20,000 (50% of 40,000)

Assuming an investment of Rs.50,000 the benefits can be as follows:

- For investors in 10% tax slab the tax savings is Rs.2,500

- For investors in 20% tax slab the tax savings is Rs.5,000

Investors in 30% slab are not eligible for Rajiv Gandhi Equity Savings Scheme (RGESS) as their taxable income exceeds Rs.10 lakhs.

Is it beneficial?

At a macro level the move is seen as a positive way to welcome savings in to equity markets, but it has its own pros and cons.

Positives

- Encourages people to invest in equities

- The flexible lock-in makes it more attractive than tax savings funds (ELSS) which have a 3-year lock-in.

- Restricted investment in large-caps or index stocks provides safety of capital

- Tax savings is an added advantage

Drawbacks

- Rajiv Gandhi Equity Savings Scheme (RGESS) is a one-time benefit only, so subsequent investments will not be eligible for tax benefits.

- The tax savings of Rs.2500-Rs.5000 may not be a significant sum to motivate people to invest. Probably the Govt. should think about higher incentives

Conclusion – Rajiv Gandhi Equity Savings Scheme (RGESS)

In a nutshell, I would say that it’s a positive signal, which can bring in some savings in to the markets. Lets assume that the intention or idea is good, but will the investor gain significantly? The answer is a mix of Yes and No because equities are risky and the returns are unpredictable. This Rajiv Gandhi Equity Savings Scheme (RGESS) has a long run benefit of educating the retail investment segment and thereby moving towards financial inclusivity in the country.

Investors have to look at equities as a way to invest systematically and build wealth irrespective of the tax sops. Since Rajiv Gandhi Equity Savings Scheme (RGESS) provides a saving of between Rs.2,500 to Rs.5,000 just as a one time benefit in the first year, its going to be a one-off benefit of a small amount. Basing your investment decision solely on tax benefits is going to disappoint many people.

Just look at Rajiv Gandhi Equity Savings Scheme (RGESS) as a small brownie for your first-time investment in equities. To be frank I would recommend investing in equities, even if Rajiv Gandhi Equity Savings Scheme (RGESS ) did not exist. Several studies have shown that investing in equities is the best way to create long-term wealth, so go ahead and start building your portfolio in 2013. Happy Investing!!!

Leave a Reply