Saving For Children – Roadmap to Saving for Children

Mr. Mehta is troubled man these days; he has to make a down payment for his house. It’s not that he does not have the money; he has one giant pool of savings; so what is the problem? Saving for children and their future needs separately is his nagging worry.

The problem is that this giant pool of savings is a free for all for all needs; so this is the account that will be used for down payment of the house; this will be used for kid’s education and eventually marriage which is a few years away.

So every time he dips into this account he feels guilty that may be when required the fund would not be sufficient to cover the expenses for the children’s college. His biggest worry is that he is not saving for children

Saving for Children – Solution to the Dilemma

1. Have separate financial goals (like how much you want to save for buying a house or how much you want to save for the college fund for kids)

2. It is also important that you demarcate each investment that you make as per the purpose so that you know where you are heading and how much you have?

3. Make sure your goals are realistic and are commensurate with your income. Also do not overestimate your returns. If a mutual fund promises 14-20% returns it’s better to plan according to 14% rather than assume that you will earn 20% and end up being disappointed.

4. If you have more than one kid keep their investments separately earmarked; it is good idea to have it in the individual child’s name so that you exactly what you have for each child.

Mrs. and Mr. Sharma have two kids; they have opened a separate trading account for both their kids and also have a separate savings account for each of them. They say it gives them more clarity and helps them stay focused about their goal.

5. Keep in mind the tenure of the investment so that you have the money when required.

Saving For Children: Optional or Mandatory ?

In India we still follow the traditional way and fund our children’s education and marriages unlike many other societies where children are pretty much on their own after they turn 18.

Today taking a loan for higher education is not difficult but often loans are given for a select few colleges and not for all colleges so one must keep that possibility in mind.

Keep in mind that the loan might be approved for a part of the expenses so certain proportion of the expenses still has to borne by the individual. In case that child wants to go abroad for education getting scholarship, grants maybe difficult and often colleges abroad ask for proof of financial creditworthiness before admitting a candidate.

Talking about the rising cost of education is like stating the obvious. Parents today are no longer satisfied with sending their kids to any college; they want the best for their children be it within the country or abroad and best is often not the cheapest!

Educating a child overseas will be more expensive than doing so within the country so that also must be factored in while planning.

So unless you are sure that your child is brilliant and will sail through the best colleges with scholarships or you think that you want him/her to be independent and fund his education you pretty much do not have a choice you will have to save for the child’s education and in India do not forget the weddings! Saving for children is crucial.

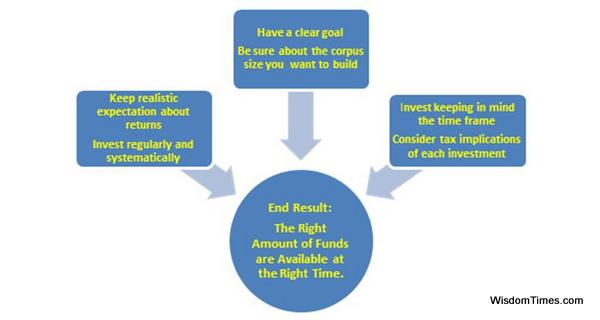

Factors to Keep in Mind When Saving for children

Saving for Children – Road Map

1. The first and foremost is to have a goal that how much you want to save and by when. Obviously you can and must review your goal from time to time as with time your earning potential will change; you may also observe that you child may develop an interest towards a specific profession so you may have to rework your plan according to that.

The goal may also have to be revised keeping in mind macro factors like the inflation, education policies etc.

2. At cost of stating the obvious the sooner you start the better it is. If you feel that your child will need the corpus at 18 and you start when he/she is 5 years old you have not just lost five years but have managed to diminish the size of your corpus by more than 70%.

If you invest Rs 10000/year @ 8% starting when the child is five years the total corpus at the end of 18 years is Rs. 2.32 lakhs. The same investment started in the first year gives you a corpus of Rs. 4.04 lakhs which is 74% higher.

As per a survey conducted by economictimes.com for ET Wealth, 63% of the respondents start saving for children when they are born and 9.2% even before the child arrives in this world.

So when it comes to saving for children, it is never too early. Do your homework well and start right away; a little prudence and some research can go a long way in fulfilling you goals.

Leave a Reply