Fall In Gold Price – Does it Worry You

Fall in gold price – does it worry you ? I would answer “Yes” to this question. I’m sure anyone who had direct or indirect investments in gold will be concerned, if not worried. The recent steep correction and fall in gold price took everyone by surprise.

Fall in Gold Price – Was this Justified or Expected? What Caused It?

Frankly speaking I did not anticipate this level of fall in gold price, where it fell from $1800 an ounce to cut below $1200 an ounce. While I’m writing this article gold prices were in the $1240-1250 range. In the Indian market Gold is roughly above the Rs.25,000 mark (per 10 gms).

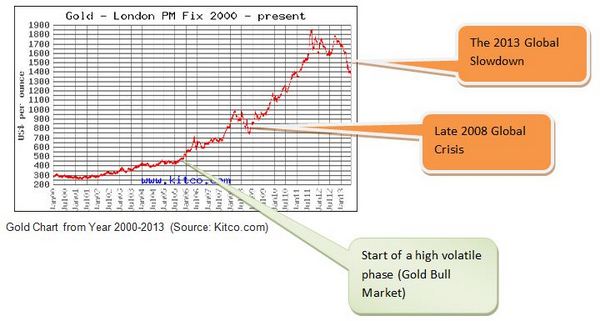

A closer look at the charts below will tell you about the gold prices in the last 2 years, as well as the long term history since the year 2000.

Source: Kitco.com & Equitymaster’s The 5 Minute Wrapup

The long term trend in the second chart clearly shows how gold has been going up since the turn of the millennium (year 2000). The growth had been gradual until year 2005, and at the start of the year 2006 Gold prices seemed to have entered a bull market phase.

Though I’m not an expert to validate this, I think this is the period when low-cost money and low interest rates helped large institutions, hedge funds and traders to bet on the future of Gold. The bull phase had lasted for a couple of years till the Lehman Crash happened in late 2008.

Post the crisis in 2008 and 2009, Gold price recovered and started looking up once again and reached even a peak of $1900 and corrected back to $1700. As we neared the end of 2012 and early 2013 the global slowdown impacted gold. Later as the US economy recovered people became bearish on Gold for two reasons:

- A belief that recovery in US and Global economy will make the dollar more attractive than gold.

- The recent announcement by Federal Reserve to reduce the stimulus by curtailing its bond buying sent shivers across the market. In simple terms the money supply in the US economy will be less, which will have an impact on investments in gold.

The other major factor was the ending of the Gold bull run, which lasted for more than a decade with successive price increase over the years.

Given this long term bull run resulting in a bubble, it had to burst and correct at some point. But the steep fall in gold price is already close to 2-year lows, and makes the prices more fair and reasonable.

Is it Time to Sell of Gold? NO – Just Follow your Asset Allocation Guideline

Selling all your gold in panic is not a good solution unless you need funds immediately for emergencies. Moreover, selling at current levels will lead to huge losses too assuming you bought at higher levels. If your investment in gold less than 15% of your overall portfolio you should be doing fine. However you need to monitor your portfolio periodically to see if your gold value has increased and take necessary steps.

Example – Keep Gold within a certain %age of your overall portfolio

Mr.Rajini invested in gold ETF over the last several years and his investment value in gold has been increasing. In the year 2012 his portfolio contained Rs.1 lakh worth in gold and Rs.1 lakh in stocks, which means 50% of his investments were in gold.

When he met a financial advisor he was advised to reduce his gold %age allocation to 15% by selling his gold. This means his gold value should be ideally around Rs.30,000 for a portfolio of Rs.2 lakhs.

However, since gold prices are depressed now, Rajini wants to wait till Diwali to fetch a better price. During Diwali Rajini plans to sell gold worth Rs.70,000 to bring the value closer to Rs.30000 or about 15% of his overall portfolio.

Lesson: Keep you allocation to gold within 10% to 15% of your overall portfolio

Some financial planners recommend just 5-10% allocation, but I would be more liberal to allow up to 15%, where you don’t find other avenues for investing.

For instance if you don’t find any stock to investor or if your FDs are not tax-efficient you just want to invest somewhere instead of keeping idle cash you can keep some funds in gold. This could be of help during any emergency or serve as a hedge against any market-wide risks which are unavoidable.

Why do experts recommend a limit or ceiling for investing in gold? The reason is obvious if you have experienced the recent turbulence in gold prices. That is one part of the answer. The other reason is the fact that gold is a static asset, which does not generate income. If you invest in fixed deposits you have interest income, in stocks you have dividend, but gold does not generate income. Instead investing in gold is beneficial only when the price of gold moves up.

Rationale for Investing in Gold

Now this brings us to the summary of the reasons for investing in gold. The reason is not for generating huge returns, but more like the following:-

- To serve as a hedge against financial assets in case markets and economy slows down dramatically. Its also a currency hedge against the US dollar.

- To meet emergencies or contingencies (long term) – don’t confuse this with short term contingency fund (which should be in cash or cash equivalent.

- To provide a hedge or insulate yourself from high inflation. Gold is an asset known to beat inflation.

Conclusion – Fall in Gold Price

The lesson that I learnt from the recent fall in gold price is to have the courage to book some profits when gold prices move up sharply. When gold hit Rs.3000 per gram I was more bullish and expected that I can hold on or add more, and failed to realize the profits. In future it may be a good idea to book profits partially and take home some money, which can be deployed for better opportunities.

However, the current market presents a good entry point to buy in very small quantities for medium-to-long term investment. People holding on to gold have to be patient until the festival season starts and prices become buoyant. Gold can be a wonderful addition to your portfolio if you can use it in the right way.

Leave a Reply