Cashflow Quadrant – Demystifying Rich Dad’s Cashflow Quadrant

Cashflow Quadrant is a framework used in ‘Rich Dad Poor Dad’ book which will reveal the secrets to becoming financially secure. All of us aspire to be successful and financially free at some point in our life. Life is full of ups and downs, but do we really know what is required to attain stable financial position and achieve true financial freedom? No, not really.

If we look at our ambitions or aspirations, most of us want to become a doctor, accountant, lawyer, engineer, etc. This is purely based on the conditioning of our mind from a very young age where parents typically want their kids to get in to one of these professions. This is also a socially acceptable norm that all of us are comfortable with. How many of us think about starting a business? This is obviously perceived to be risky and avoided without much thought.

Cashflow Quadrant – The Turning Point

Have you ever thought how drop-outs such as Bill Gates made it to the billionaire’s club? Were Richard Branson, Micheal Dell and Ted Turner highly qualified, super intelligent or did they have some extraordinary talent? You will be astonished to know that professionals such as engineers, accountants and the brightest graduates and PhDs want to work for them.

The Cashflow Quadrant is a framework used in Rich Dad Poor Dad book which will reveal the secrets to becoming financially secure. This will help us understand why some people work less, earn more and pay less in taxes, and become financially secure.

How does Cashflow Quadrant work?

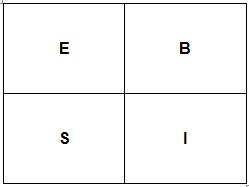

They Cash Flow Quadrant framework says that there are four types of people broadly in this world, which are represented by four letters E, S, B & I. These letters stand for the following: –

- E- Employee

- S- Self employed

- B- Business

- I- Investor

The cashflow quadrant is a 2×2 matrix as shown below:

E: Employee refers to people who is employed somewhere. This covers different types of employees including engineers, accountants, bank executives, professors, chemists, etc. Anyone who works for a salary falls under this category.

S: Self employed are those who work for themselves. This would include professionals who have their own practice or unit from where they provide their services. Example: Your neighborhood doctors who has his own private practice, financial advisors, private fitness experts, independent tutors, etc. These people either have their own office or work premises or could work from home or a home office. This is different from business, because this requires their full time involvement and attention.

B: Business– This segment includes people who have started their own business – right from mini start ups to the largest corporation. E.g. Small business: A small electric appliance store in a good location, medium sized business: A large super market, large business: Companies listed on stock exchange such as Tata Motors, Infosys, etc. Even the most largest and successful companies started small at some point of time and reached greater heights.

I: Investors – This includes investors who invest in productive assets to create a steady stream of cashflows and build an asset that appreciates in value. E.g. Investing in stocks, real estate, fixed deposits, etc.

Where Should One be on the Cashflow Quadrant?

The examples shown above are purely basic illustrations. But in order to achieve financial stability and freedom one has to know how to move from the left side of the quadrant (E & S) to the right side of the quadrant (B & I). Although there is nothing wrong in being in all parts of the cashflow quadrant (E, S, B & I) the focus should be to move in to Business (B) and Investing (I).

How Can One be In Different Roles at the Same Time?

This is possible regardless of your profession provide you are able to tap various opportunities. For instance a senior college professor, say Prof. Ramamurthy could be employed in an educational institution – HST College (E-Employee), and provide independent tutoring on weekends at home (S-Self Employed), own a coaching company which is professional run by a team employed by him (B-Business Owner), and also invest in stocks and fixed deposits (I-Investor). Practically, it may sound difficult to be in all 4 quadrants, but one can definitely play a role in 2 or more quadrants.

How B & I helps you to succeed rather than E & S?

Let me put a disclaimer here to say that there is nothing wrong in being on E & S. But your focus should be to get in to B & I as well. If you are happy remaining in E & S then it can put some hurdle on your primary aim of becoming financially free. This is not a suggestion to give up your job or profession, but to tell you think much beyond that.

The Business and Investing skills and benefits are not taught in school, which is reiterated often by Robert Kiysaki, the author of Rich Dad Poor Dad. He shows the latent defect of our education system which is designed to make us good Employees and Self-Employed professionals only. At school or college one does not learn about business or investing except for a few theoretical concepts.

| Employee & Self Employed | Business Owners & Investors |

| Employee looks for securitySelf Employment is based on trust | Business owners are visionaries and risk takersInvestors are deal makers |

| A stable salary or fees | Income from business or investments which is variable and subject to market risks. However, these risks are manageable or can be eliminated in some cases. |

| More work, less time | Less work, more time (However, one may have to work more during start up stage until your idea becomes successful) |

| Personal involvement necessary at all times. Impact on your health or personal life impacts employment/practice directly. | Personal involvement is not necessary if you have professionals. Impact on health or personal life may not impact the business if you have a professional team to run the operations. Investments need not be affected if you manage it well |

| Solo playersNo advisers to help or solve issues | Team PlayersProfessional advisers are employed and work to help you solve issues, find ways to improve business, finances, etc. |

| Earn and save policy | Earn and invest in productive assets that in turn generate further income |

| Dependant on social security (401k) or pension for financial freedom or retirement | Initially you build a business which provides income automatically. Similarly you invest your incomes in assets – both physical and financial assets that provide income streams and grow in value too. |

| Income taxed before you can spend in case of employees. In case of self employed you can deduct some expenses which is an advantage. So you have less money to utilize. | You can spend on the income before it is taxed, so you have more money to utilize. |

| Money saves is just enough to manage your budget or save little for future | Money saved is substantial, so you can save some and invest the rest in other assets that can provide further income streams. |

The key learning here is to move to the ‘B’ and the ‘I’ quadrant over a period of time. Business is like a team sport so you need to be able to invest in the right kind of team with the right mix of professionals. This will help you achieve the goals and missions you have for your business.

Similarly Investments have to be done after a good amount of research and understanding of the asset or instrument and its features. Given the power of a team, people in ‘B’ and ‘I’ quadrant make more money than those in the ‘E’ and ‘S’ quadrant.

Conclusion – Rich Dad’s Cashflow Quadrant

I would recommend you to further read “Rich Dad Poor Dad’s Guide to Investing”, which shows us where the successful rich people invest in. If you have read these two you will be ready with full of ideas and enthusiasm to start something on the ‘B’ and ‘I’ quadrants. Wish you all the very best.

Leave a Reply