Which is the Best Mutual Fund in India

If you are a newbie to investing, then these are some questions you may typically have:

1. Which is the best mutual fund in India?

2. Which type of mutual fund do I choose? Debt funds, Equity funds, balanced funds?

3. Without doing much research, how do I pick mutual funds in India ?

4. How do I identify a good performing fund? What makes a fund a good mutual fund?

These are all valid questions and to get to the first question of “which is the best mutual fund in India to invest in now”, you need to be able to answer the rest of questions first

Ratings and Reviews for Movies, Books as well as Mutual Funds

Many people rely on ratings and reviews for choosing movies, laptops, digital cameras, etc

So Why not a simple rating or review for mutual funds? This should definitely make investors’s life easier. Keeping this in mind we will discuss how to pick the best mutual funds in India using ratings/rankings and other supporting information. The website www.valueresearchonline.com is an excellent resource for mutual fund ratings.

1. Which type of mutual fund do I choose? Debt funds, Equity funds, Balanced funds?

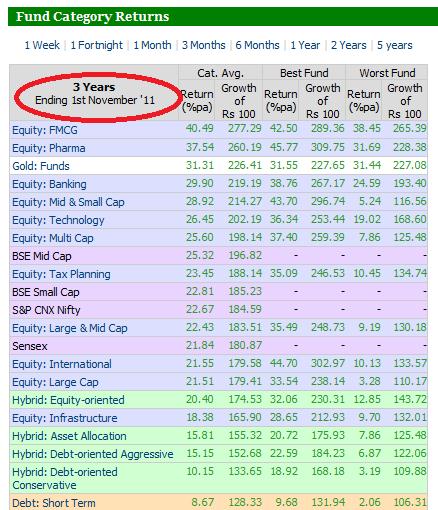

On the front page of Valueresearchonline, look at the bottom right hand corner to review the “Fund Category Returns” section

One crude way is to look at the category returns for past 3 years or 5 years and identify good long term performers. In this case, even though FMCG and Pharma sectors have done well over last 3 years, it is not advisable to invest in “sector specific” funds since they are cyclical and are vulnerable to risks of downturn in one industry/sector. Preferably choose diversified equity or Large Cap investments.

In this article we will focus on just equity funds. But read our blogs below to help in choosing fund category

- Types of Fund in India – Debt, Equity or Balanced

- Diversified vs. Index vs. Thematic Funds – When to choose one over other?

For starters, Equity Large Cap has given good returns, along with a moderate or low level of risk. If I click on “Equity: Large Cap” in Fund Category Returns section, I get a list of large cap funds with their respective details.

2. Without doing much research, how do I pick mutual funds in India ?

a. Ratings

b. Rankings

These are two ways to identify good funds.

Ratings

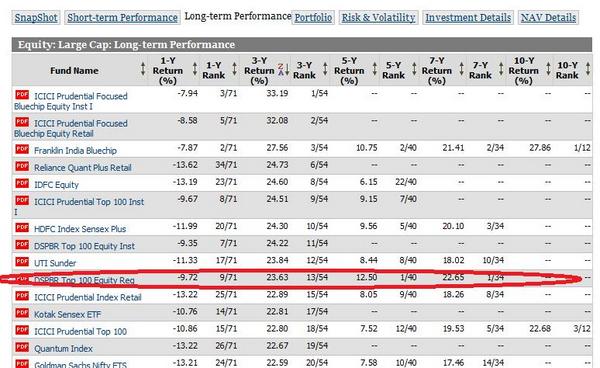

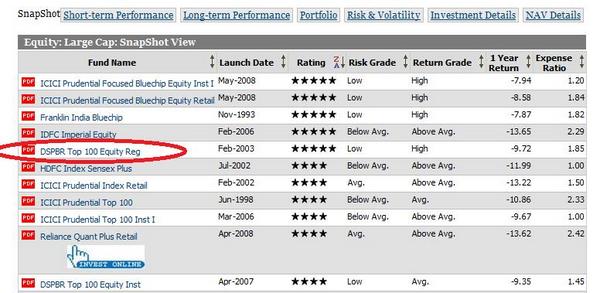

If I click on “Equity: Large Cap” I get a list of large cap funds as shown in the next screen. If I filter this list by “Ratings”, then all 5 star funds come to the top. You can find that “DSPBR Equity Top 100” is a recognizable brand name and highly rated fund. It could be a good choice.

Rankings

Also in the “long term performance” tab, you can see that the same fund has decent rankings. DSPBR Top 100 shows a ranking of 9/71 (9 out of 71) which is good. So it might be a good potential investment.

Now you can make a short “list of funds” using this technique

Fund Analysis Table

Another quick way is to pick the best rated fund – purely based on fund ratings. To get a quick snapshot of fund ratings go to http://www.valueresearchonline.com/funds

This section provides a quick snapshot of all 5-star rated funds. (Generally ratings start from one star to five star – 5 star being the highest rating).

If you are someone who just wants to know the best funds as of now without detailed analysis, just pick up a few 5-star funds out of these categories. But if you want to make an informed choice for your portfolio check out questions 3 & 4 as well.

3. How do I identify a top performing mutual fund in India?

To answer this question, you need to do a bit of detailed research on the shortlisted funds in your list.

Fund Snapshot

I would recommend that you click on these funds and see the details of the fund to know the fund features, scheme info, portfolio components, style of investing, etc. Let’s say I click on HDFC Equity fund which is 5-star rated I will get a snapshot of the fund. A sample screen shot of the same is provided below.

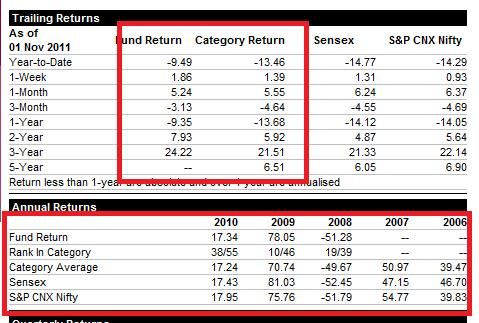

For this fund we have 6 tabs or sections – Snapshot, Performance, Portfolio, Analysis and Fund Details. What we see above is one half of the Snapshot section, which provides recent statistics and fund facts followed by trailing returns. The Trailing returns (circled above) show you the fund’s performance over short term to long term ranging from 1 month to 5 years and also compares the same with returns in the fund category shown under the column ‘Category’.

Performance

This section gives you an insight in to risk, returns and performance of the fund over different periods. Some terms and jargon can be technical in nature, but most of the information is simple to comprehend.

Trailing returns and Annual Returns are the key parameters to look at. Typically mutual funds are expected to give better returns that the SENSEX or Index funds. So you need to identify funds that have done better and have potential to do better in future. You can also identify consistent performers from the seasonal ones. Equity funds are supposed to provide consistent returns for medium to longer periods (from 1- 5 years), so don’t get carried away by short term returns. Periodic returns and performance can be compared as shown in the Trailing Returns and Annual Returns table alongside.

Portfolio:

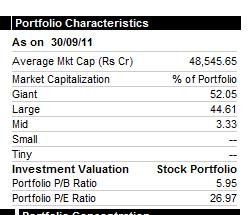

This section talks about the portfolio of stocks, allocation across sectors, etc.

If you want to play it a bit safe, then pick funds which invest predominantly in Giant and Large cap stocks. So the % indicated in the diagram should be predominantly “Giant” or “Large”. Such funds are much safer.

If you want to play it a bit safe, then pick funds which invest predominantly in Giant and Large cap stocks. So the % indicated in the diagram should be predominantly “Giant” or “Large”. Such funds are much safer.

Large cap funds invest in companies with large market capitalization, which would be large corporates with a significant leadership in an industry/sector and presence in diversified markets and product segments. This is highly recommended for conservative investors.

Funds that invest in mid cap, small cap or tiny cap “may” yield better returns, but they are that much more riskier. Small cap and tiny cap exposure should be kept to a minimum or avoided altogether unless you have the appetite to absorb volatility and losses, but it may work well in long term.

Fund Details

This section gives you basic information about the fund such as fund type, minimum investment, entry/exit loads, etc.

Hopefully now you will be in a position to answer the first question “Which is the best mutual fund in India to invest in” on your own. It all depends on your risk appetite. Master this method of finding good mutual funds, so that you can independently validate your financial planners advise

Ask Value Research

By now you will be equipped to choose funds, but if you still have further queries you can ask/post questions on Value Research. Value Research experts will answer your queries and provide personalized advice on your portfolio.

For people who want to know the basics I would recommend you to read Basics of Mutual Funds and How to choose a mutual fund on Wisdom Times.

Leave a Reply